Coronavirus COVID-19

YOUR HEALTH AND SAFETY IS OUR CHIEF CONCERN.

Latest Update on 9/13/2022

BRANCH CHANGES

We will continue monitoring and observing any limitations to contact associated with the CDC recommendations that may impact our branch operations.

All AHCU branch locations are open to serve members in both lobby & drive thru. We will continue operating in a safe manner and provided any necessary updates to our branch operations as needed. Please note, our Anoka branch is permanently closed.

LOBBY HOURS:

SAT: BY APPOINTMENT

CONTACT US - 763.422.0290 to Schedule an Appointment or for Safe Deposit Box Access on Saturdays.

DRIVE THRU HOURS:

M - F: 8:30 AM - 5:30 PM

SAT: 9:00 AM - 1:00 PM

LOBBY & DRIVE THRU SERVICE AVAILABLE (M - F):

CHAMPLIN

CIRCLE PINES

COON RAPIDS

FOREST LAKE

ST. FRANCIS

PERMANENT BRANCH CLOSURES INCLUDE:

ANOKA

BRANCH SAFETY PRECAUTIONS

In order to keep our employees and community safe, we ask that you do not enter the building if you have been exposed to, or have had any, COVID-19 symptoms within the past 14 days.

We have outlined the precautions we are taking below. However, these may change at any time should additional safety concerns become present. Please be aware that the Anoka branch has been permanently closed.

- Masks are recommended by all individuals visiting a branch lobby.

- Sneeze guards are in place in designated areas or as requested by members.

- Social distancing is recommended.

- Offices will be cleaned and disinfected as needed.

OTHER WAYS TO ACCESS YOUR ACCOUNTS

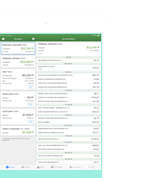

AHCUdigital & Mobile App

- Check your balance

- Make Payments (Outside AHCU Requires Bill Pay Service)

- Pay your bills

- Transfer funds

- Transfer to others outside of AHCU

- Manage your credit

- Manage your budget

- Review your statements

- Apply for a loan

AHCUface2face Video Chat

- Transaction History or Card Related Questions

- Place an ACH or Share Draft Stop Payment

- Make a Loan Payment

- Transfer Funds

- Ask General Account or Membership Questions

- Report Your Debit or Credit Card Lost/Stolen

Phone Branch &

AHCU Call Center

763.422.0290

Toll

Free: 1.800.785.2428

Call Center hours are the same as branch drive thru hours.

Debit & Credit Cards

Report Card Lost/Stolen

Debit: 1.800.535.8440

Credit: 1.800.422.4757

OPEN A NEW ACCOUNT

Open a New Account -

To get started, here is what you'll need:

- Government issued ID/Drivers License/State ID or Passport with current address

- Your complete physical and mailing address

- Social Security Number

- Date of Birth

- If you are requesting the account to be joint, they will need to enter and validate their information as well.

- Once your new account is approved and you'd like to fund it by electronic transfer from another financial institution, you’ll need their routing number and your account number.

What Type of Accounts Are Available to Open Online?

- Membership Share Savings

- Personal Checking Account

- Money Market Savings

- Share Certificates

Ready to Get Started?

Become a Member Add to My Membership

Already Applied?

Check My Application Status

Business Account? Please contact your local AHCU branch for further assistance.

OTHER WAYS TO CONNECT WITH US

There may be times when you have questions or concerns about all of the recent changes, we get it and we're here for you. Here are the some of the other ways you can connect with us.

CONNECT WITH US BY EMAIL

Please Note:

To protect your information, we will not provide any personally identifying information via email.

Please do not send any account or other personally identifying information to us via email or social media.

EVENTS

Check back for new AHCU events!

CORONAVIRUS COVID-19 RESOURCES

Center for Disease Control

https://www.cdc.gov/

World Health Organization

https://www.who.int/

LSS Financial Counseling

https://www.lssmn.org/financialcounseling/ or call 1.888.577.2227

Minnesota Department of Health

https://www.health.state.mn.us/diseases/coronavirus/index.html

Beware of Coronavirus Related Scams

https://www.ftc.gov/

Internal Revenue Service

https://www.irs.gov/coronavirus-tax-relief-and-economic-impact-payments

Newtek Business Solutions

https://www.newtekone.com/

US Treasury Department

https://home.treasury.gov/

Find Credit Union PPP Participants

https://www.sba.gov/paycheckprotection/find